How to Resolve Tax Disputes with the IRS: A Guide to Alternative Dispute Resolution (ADR) Programs

- Heath Vo, JD, CPA

- Jun 10, 2025

- 3 min read

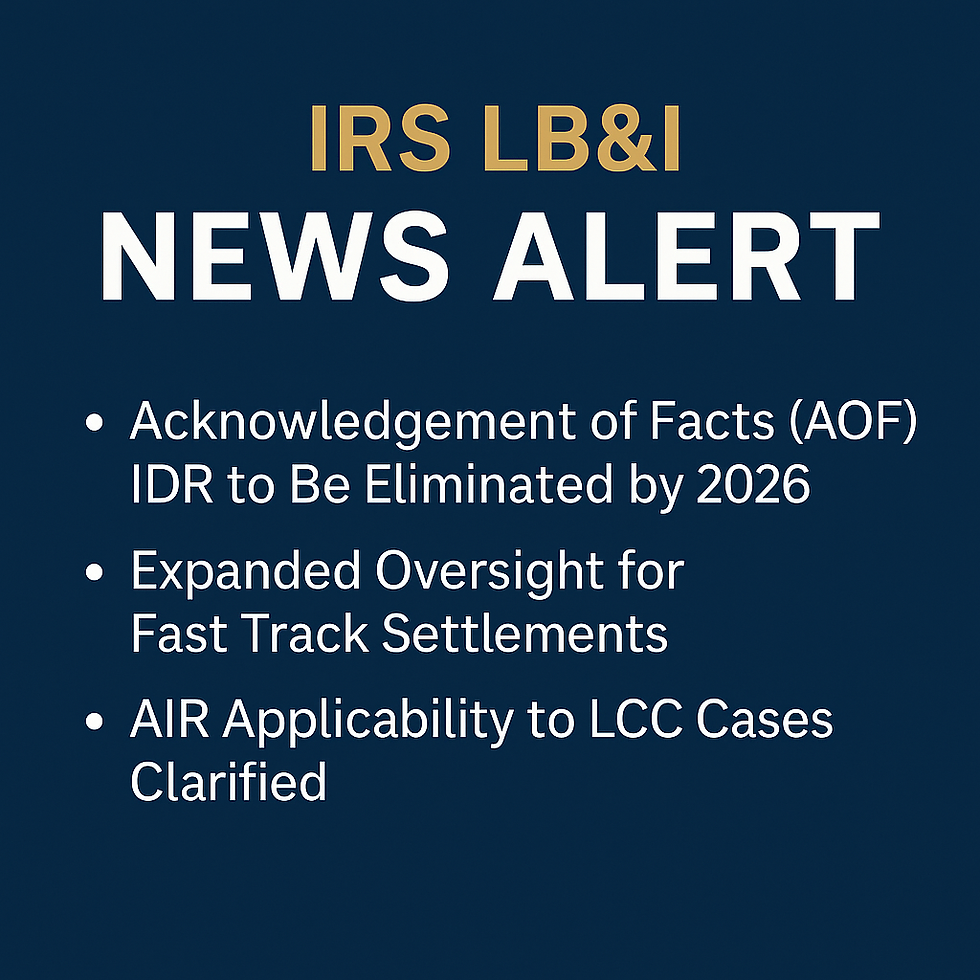

IRS Alternative Dispute Resolution (ADR) programs offer taxpayers a faster, less adversarial way to resolve tax disputes without going to court. Managed by the IRS Independent Office of Appeals, these programs use mediation and settlement strategies to help taxpayers and the IRS reach fair, mutually agreeable outcomes.

Why Consider ADR for IRS Tax Disputes?

If you’re under IRS examination or facing unresolved tax issues consider utilizing an IRS alternative dispute resolution program which provides:

Faster resolutions compared to traditional appeals,

Lower legal and administrative costs,

Confidentiality throughout the dispute process

Neutral mediation by trained IRS professionalsAvoidance of tax litigation in U.S. Tax Court

ADR are voluntary and optional. It is important to have a knowledgable and experienced person to help guide your way.

Types of IRS ADR Programs

Fast Track Settlement (FTS)

Fast Track Settlement is designed for taxpayers currently undergoing an audit prior to any Statutory Notice of Deficiency.

Key Features: Uses an IRS Appeals mediator to assist in resolving issues quickly (within ~60 days).

Eligibility: Available to small businesses, self-employed individuals, and certain large businesses.Benefits: Keeps the case out of court while saving time and expense.

Tip: Always request fast track in an unagreed case. If you don't like the offer, you an go right on ahead to the regular appeals process. It is important to consult an experienced and knowledgable professional in IRS processes and procedures.

Post-Appeals Mediation affectionally referred to as "Aunt PAM"

Post-Appeals Mediation allows a second chance to resolve tax disputes after an Appeals conference has failed to reach agreement. Affectionately called "Aunt Pam" - you know that weird Aunt no one knows what to do with and wishes didn't come to Thanksgiving? This was a bright-idea by someone who needed a special project to justify their pay.

Key Features: Involves a neutral mediator from the IRS Office of Appeals.

Eligibility: Available for factual or legal disputes that are fully developed but unresolved.

Important Note: The presentation of 'new facts' may result in your case being returned to field examination. New interpretations of facts previously presented to an IRS employee do not constitute new facts not adjudicated by the IRS field agent. New legal therories will not necessitate a return to the field examiner.

Rapid Appeals Process (RAP)

RAP helps resolve large and complex tax cases through structured mediation techniques—before formal appeal proceedings are completed.

Key Features: Accelerates resolution of complex tax issues, especially for businesses and high-net-worth individuals.

Who Should Use IRS ADR Programs?

ADR programs are ideal for small businesses or self-employed individuals under audit. taxpayers with unresolved issues after IRS Appeals, or Tax professionals seeking faster resolution for clients, and large corporations dealing with complex tax matters. Basically - anyone that has an adjustment in an examination. This process can also be strategic in reducing IRS adjustments.

Where do I get started with ADR?

Talk to an experienced person at ExFed Tax. Let them explain the process and potential strategy. Schedule a consultation to learn more about your options.

Final Thoughts: IRS ADR as a Smart Tax Resolution Strategy

Every taxpayer should seek an ADR for unagreed issues! Using IRS ADR programs can save time, money, and unnecessary stress—especially when facing complex or drawn-out tax disputes. As former federal agents, ExFed Tax specializes in navigating these exact processes with precision and confidence.If you’re ready to resolve your IRS tax dispute efficiently, contact ExFed Tax today for a consultation.

Comments