top of page

Search

Strategic Advisory

From Paper Mountains to Digital Milestones: Honoring Heath Vo’s Commissioner’s Award

ExFed Tax founder Heath Vo earned the IRS Commissioner’s Award for modernizing Estate & Gift operations and leading the push to digitize paper returns.

Michelle McIllwain

Oct 10, 20254 min read

Able to Work: How One Houston Coffee Shop and the Tax Code Brew (Inclusive Hiring Tax Incentives)

“Inspired by Bitty & Beau’s Coffee in Houston, this story shows how inclusive employers turn compassion into smart strategy. Learn how federal, Texas, and Tennessee tax incentives reward businesses that hire individuals who are ‘able to work.’”

Heath Vo, JD, CPA

Oct 5, 20253 min read

IVF, Egg Donation & Surrogacy: How to Make the Tax Code Work for You

IVF, egg donation, surrogacy — each comes with complex costs, and the IRS doesn’t make it easy to tell what’s deductible.

Our founder, Heath Vo, JD, CPA (who’s walked this journey personally), breaks it all down in a clear, human way — so you can focus on growing your family, not your tax bill.

Heath Vo, JD, CPA

Oct 4, 20253 min read

Heading into 2025: Tax Strategy Moves You Shouldn’t Ignore to Reduce 2025 Taxes

Learn how the One Big Beautiful Bill Act (OBBBA) impacts your 2025 taxes. ExFed Tax explains new deductions, credits, and strategies to legally reduce your tax bill.

Heath Vo, JD, CPA

Sep 25, 20255 min read

So, You Got an IRS Letter? Don't Panic - Yet.

It’s not a love letter, clever invitation to Church, or one of those letters with your name or "current resident". But it is important ....

Heath Vo, JD, CPA

Aug 4, 20254 min read

SAFE Tax Filing Act of 2025: Taxes After Domestic Abuse

Imagine this: It’s tax season. You’ve escaped an abusive partner, started over, and now the law requires you to file…with them. Romantic? No. Dangerous? Absolutely.

Heath Vo, JD, CPA

Aug 2, 20254 min read

Cryptocurrency, Taxes, and You: How Not to End Up Explaining Dogecoin to the IRS

Learn how cryptocurrency transactions affect your taxes. From reporting Bitcoin gains to avoiding IRS penalties, here’s your 2025 guide to crypto tax compliance.

Heath Vo, JD, CPA

Jul 31, 20253 min read

How to Request IRS Penalty Abatement - A Guide to IRS Form 843 and IRS Penalty Relief

Quick Take on IRS Penalty Relief Got hit with IRS penalties? You might be able to get them reduced or wiped out. The official vehicle...

Heath Vo, JD, CPA

Jul 25, 20258 min read

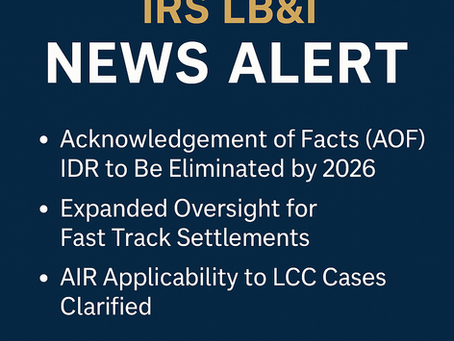

The IRS Wants to Fast Track Corporate Exams: But Will These 2025–2026 Changes Actually Work?

IRS’s Large Business & International Division (LB&I) has announced sweeping changes aimed at speeding up large corporate examinations. On paper, it’s all about efficiency: less red tape, more collaboration, and faster certainty for taxpayers.

Heath Vo, JD, CPA

Jul 25, 20253 min read

Divorce & Taxes: What to Know When the Spark Fades as seen on #ColdPlayKissCam (and the IRS Notices)

At ExFed Tax, we’ve seen some things implode—business partnerships, aggressive tax shelters, and yes, even that Coldplay concert kiss cam...

Heath Vo, JD, CPA

Jul 20, 20253 min read

THE BIG, BEAUTIFUL TAX BILL: WHAT IT MEANS FOR YOU AND YOUR DEDUCTIONS

Move over, standard deduction. There's a new sheriff in town—and it brought a suitcase full of write-offs. In a year already full of...

Heath Vo, JD, CPA

Jul 20, 20252 min read

Starting Smart: Tips for Starting a Small Business with Success (With a Little Help from ExFed Tax)

Starting a small business is exciting—but mistakes in taxes, marketing, or setup can cost you big. From social media tips to SEO basics and smart tax moves (like hiring an accountant before things get messy), this blog breaks down what every entrepreneur needs to know. Ready to launch with confidence? The former IRS pros at ExFed Tax are here to help.

Heath Vo, JD, CPA

Jun 16, 20253 min read

bottom of page